Tax rebate under section 87A of the Income-tax Act, 1961 is a benefit that reduces the total income tax liability of an eligible taxpayer. The eligibility criteria are that the taxpayer’s income should be below a set threshold and not having certain types of income. For example, one of the criteria for tax rebate under section 87A is to have an income below Rs 5 lakh (old tax regime) or Rs 7 lakh (new tax regime). However, following an update in the ITR filing utility on July 5, 2024, chartered accountants say that many taxpayers were denied the benefit of tax rebate under section 87A if they had certain special rate incomes like short-term capital gains (STCG). STCG on equity shares or equity-oriented mutual funds were taxable at 15% rate under Section 111A which was raised to 20% in Budget 2024 presented in July this year.

What is the issue that is causing such problems regarding claiming of 87A tax rebate

According to an earlier Economic Times report dated July 21, 2024, the ITR filing utilities stopped allowing tax rebate under section 87A for various special rate incomes including short-term capital gains on equity shares or equity-oriented mutual funds taxable at 15% under Section 111A.

“Earlier the Income Tax Utility Software allowed filing of ITRs with rebate, but after July 5, 2024, a whole controversy arose due to change of schema of utility software by the income tax department. Pursuant to those ITRs which were filed with tax rebate are now getting intimation notices for tax demand equivalent to amount to rebate availed. Recently, more than 500 demand notices were received by members of Chartered Accountants Association Surat. Where there was a refund due, the amount of rebate was deducted from it after processing of the ITR,” says CA Hardik Kakadiya, President, Chartered Accountants Association Surat.

Once the rebate facility was stopped, taxpayers could not claim 87A rebate in conjunction with the special tax rate like STCG. Many people were previously allowed to make this claim, and now they are receiving tax demand notices as a result. “Those taxpayers who have claimed rebate, using old utility or adjusting 87A rebate amount, are now getting a tax notice wherein tax demand is raised with reduced amount of rebate,” says Mihir Tanna, Associate Director- direct tax, S.K Patodia & Associates LLP, a CA firm.

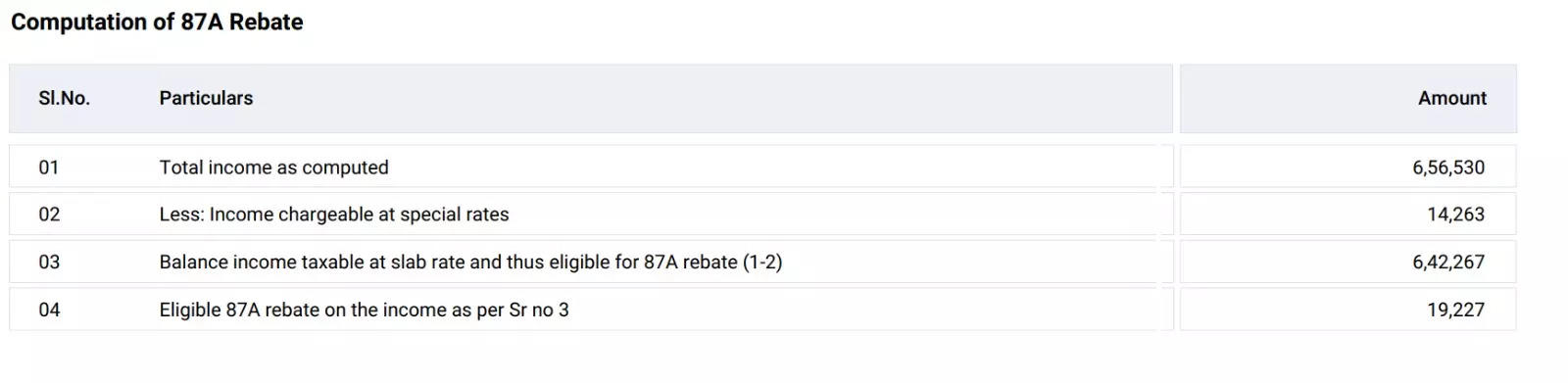

Some of Tanna’s clients received a tax notice for claiming an 87A tax rebate on STCG income. In one of the cases cited below, the taxpayer filed his ITR on July 13, 2024, and it was processed on September 20, 2024. The taxpayer claimed Rs 21,366 as a tax rebate under section 87A; however, the tax department adjusted the tax rebate to Rs 19,227.

Source: S.K Patodia LLP (section 143(1) intimation order)

“Unlike section 112A (which deals with tax on long term capital gains (LTCG), inter-alia, on sale of equity shares and equity mutual funds on which STT is paid) which restricts the benefit of rebate under section 87A of the ITA, section 111A (which deals with the taxability of short term capital gains (STCG) on equity shares and units of mutual fund, etc on which STT is paid) does not specifically restrict benefit of rebate under section 87A,” says Dipesh Jain, Partner, Economic Laws Practice.

“Section 87A rebate is not available on income from long term capital gain on transfer of listed equity share, unit of business trust, or an unit of equity-oriented funds. Further, this rebate is available only to resident individuals in India and not available to any non-resident taxpayers. section 87A rebate can be claimed against STCG from equity shares and equity oriented mutual fund for a resident individual. As such, there is no explicit restriction laid out in the law,” says Yogesh Kale, Executive Director, Nangia Andersen India.

What can you do now if you have got this tax notice due to claiming 87A tax rebate?

Tanna says there are two possibilities now. The first is for the tax department to send you a tax notice disallowing the tax rebate under section 87A claim for STCG, etc. The second possibility is the tax department re-processing your already processed ITR under section 154. This means if your ITR is processed successfully by applying tax rebate under section 87A, then it may be disallowed now to rectify this mistake.

“Those ITRs processed without reducing rebate amount may receive intimation under section 154, rectifying the earlier intimation issued under section 143(1) and tax demand will be raised,” says Tanna.

“Many of our clients have started receiving intimation orders with tax demands in the last 4-5 days. At the time of filing of ITR, as per the utility provided by the income tax department, Rebate under section 87A was allowed to taxpayers in the new regime who had special rate income (like short-term capital gains, etc.). Government brought changes in the ITR filing utility, in the month of July 2024 by not allowing rebate under section 87A against special rate incomes. Now, at the time of processing the ITRs, the income tax department has applied this change in the ITRs filed earlier also. (i.e. before making an amendment in the utility) Due to this, ITRs filed before the change are now getting demand notices. In these cases, the only option left is to pay the tax demand,” says CA Abhishek Soni, co-founder, Tax2Win.

“Taxpayers have faced practical difficulty in claiming the rebate under the ITR utility for AY 2024-2025 qua STCG. Representations have been made to the government to address this concern in the ITR. Having said so, taxpayers should claim the rebate under section 87A of the ITA as and when possible. Further, the escalation before appellate authorities may depend upon factors such as cost and time involved. Taxpayers could also explore filing rectification letter with jurisdictional assessing officer to plug such discrepancy,” says Jain from Economic Law Practice (ELP).

— CAHimankSingla (@CAHimankSingla)

Why is the income tax department not allowing 87A tax rebate on STCG

Short-term capital gains used to enjoy tax rebate before the July 5, 2024 update made in the ITR filing utility.

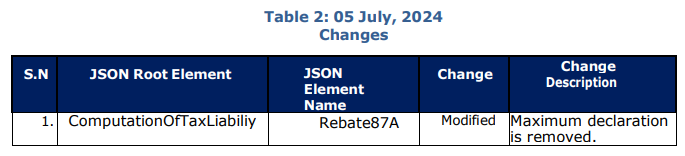

Source: Income tax ITR-2 schema

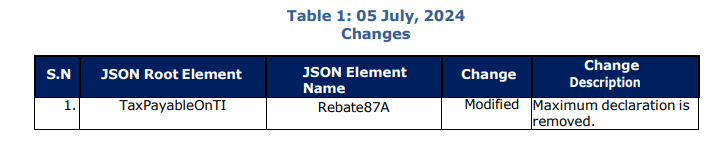

Source: Income tax ITR-3 schema

“There is a condition as per Section 112A (6) that such rebate is not available on Long Term Capital Gains. This condition is only for long term gains, and not for short term gains, and ideally STCG cases still have to be eligible for tax rebate under section 87A. But the logic process of software implemented by the ITD Portal treats both the gains (LTCG and STCG) the same and is not allowing rebate even on short term capital gains. An ill-interpretation of the words “Notwithstanding anything contained in this Act but subject to the provisions of this Chapter” as given in Section 115BAC (1A) which was inserted with effect from 1st April 2024, is the root cause of the whole issue, but the law has to give beneficial interpretation in favour of the taxpayer,” says Kakadiya from Chartered Accountants Association Surat.