VIJAYAWADA: Andhra Pradesh and Telangana have topped the list in average per person loss of Futures and Options (F&O) trading for FY 2023-24, according to the latest report released by the Securities and Exchange Board of India (SEBI).

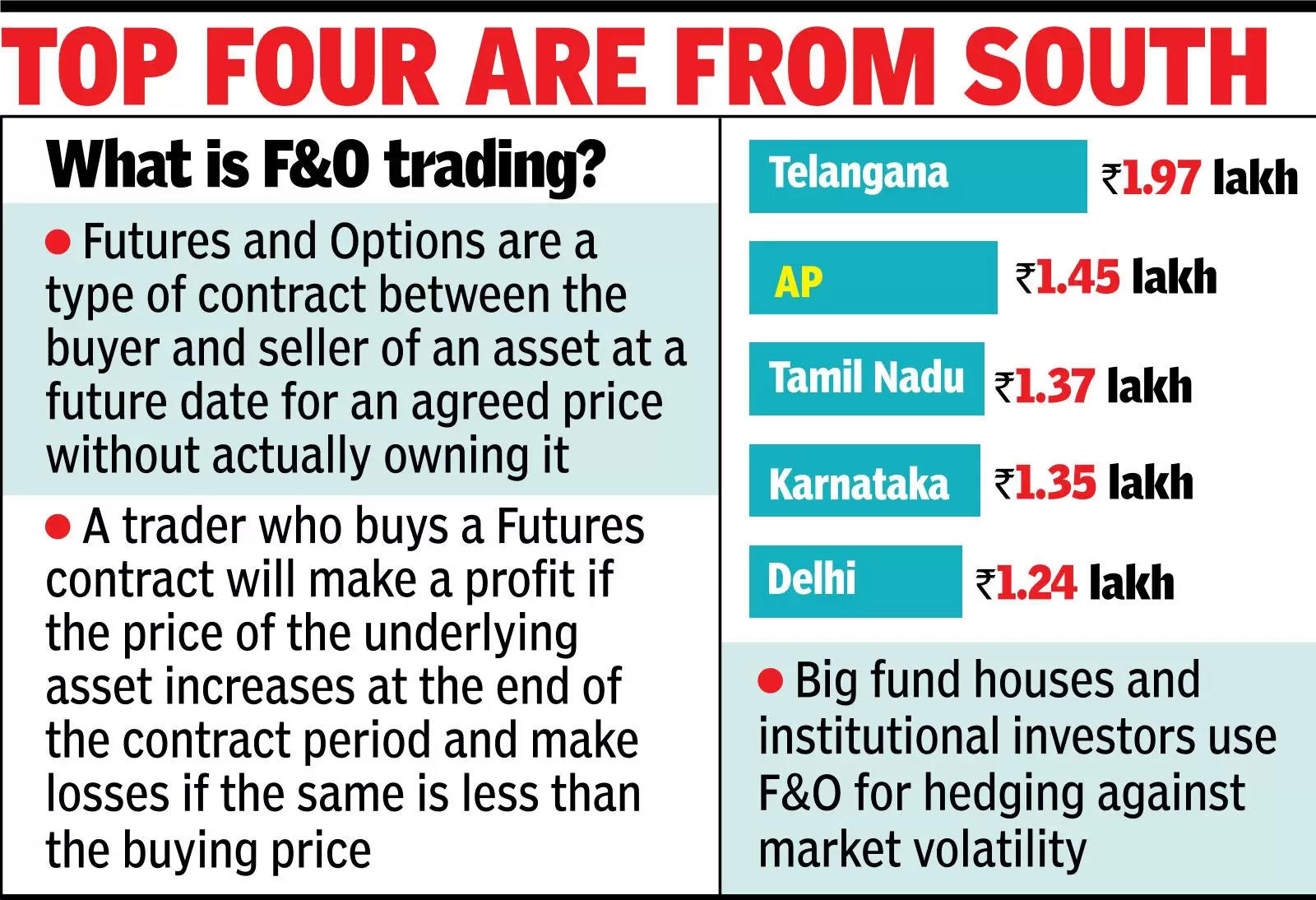

While Telangana occupied first place with Rs 1.97 lakh per person average losses, traders from AP incurred Rs 1.45 lakh average losses. In fact, the top four states in the list are from South India, with Tamil Nadu third with Rs 1.37 lakh loss per capita, followed by Karnataka with Rs 1.35 lakh per person losses.

While occupying the first two places in terms of average per person losses, Telangana and AP occupied 12th and 13th places in terms of number of F&O traders. The two Telugu states have 2.1 lakh traders each trading in F&O. The SEBI report revealed that 93% of F&O traders incurred losses in FY 2023-24.

South Indians new to trading, hence lose money

Former vice-chairman of AP planning board and stock market guru, Ch Kutumba Rao, observed that the reason why South Indian people are losing more money in F&O trading is because more number of people work in the IT industry with high-income jobs.

They think that they are smart people, but the market is smarter than them, he said. He further noted that people from western India and northern India are more cautious with their money.

“They do invest in stocks but do less speculating, while F&O trading is pure speculation which should be used as a hedging tool but not for investing or double the money,” Rao added.

Even otherwise, people from northern and western parts of the country are more experienced than those from South India, he said, adding that a majority of South Indian traders are new entrants in the markets post-Covid-19.

“One mistake that the younger generation of traders is making is that they are not looking at the behavioural aspects of stock markets. The volatility in the markets has increased a lot in the last decade. People who think they are digitally savvy and can handle volatility are taking risks with F&O trading and ending up on the losing side. You are bound to incur losses if you do not know how to balance volatility and risk in the markets. Another reason for the increased number of traders entering F&O trading is the discount broking companies which are offering trading at no cost with just a click of a but- ton. This phenomenon increased post Covid-19,” said Kutumba Rao.